Speed to Scale: Unlocking Post-Close Value in Today’s M&A Landscape

Presented By: Insperity / Sales Xceleration

In today’s high-cost, long-hold M&A environment, immediate post-close growth is critical. This panel explores actionable value creation strategies private equity firms and portfolio company leaders can implement right away. Topics include accelerating revenue, building scalable processes, leveraging data, managing talent through transitions, and effective integration. Panelists will share real-world insights and case studies to help attendees drive performance during the crucial early period post-acquisition—and ultimately position their companies for a stronger, more profitable exit.

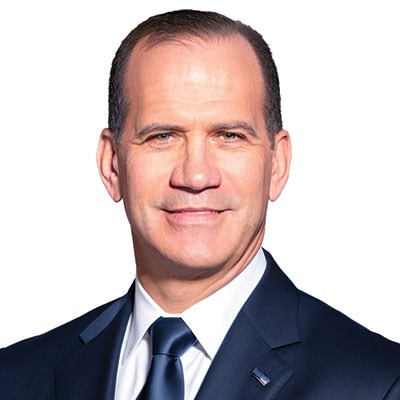

Moderator:

CDO

Sales Xceleration

Daniel Steyn serves as the Chief Development Officer at Sales Xceleration, where he also co-heads the company's Private Equity practice. Before joining Sales Xceleration, Daniel was a key member of the leadership team for the Middle East, Turkey, and Africa, where he focused on driving market expansion and growth strategies.

Sales Xceleration helps PE Firms and their PortCo's create repeatable, scalable, profitable revenue growth by implementing and executing a defined sales strategy, process and methodology. With over 6k client engagements, and increasing client revenue by an average of 32% in the first year, Sales Xceleration’s results speak for themselves.

Panelists:

Private Capital Advisor

Insperity

Amanda Cooper Benbow, СВРА, is a visionary strategist with a proven track record of collaborating with premier private equity firms, investment firms, and family offices to orchestrate seamless mergers and acquisitions. With unwavering precision, Amanda delivers bespoke human resource infrastructures that empower organizations to navigate complex transactions with ease. Her mission is to elevate both the firm and its current/future investments by offering comprehensive solutions for procurement, administration, and ensuring absolute compliance across all facets of human resources. Amanda's expertise and commitment to excellence set the gold standard in driving success and sustainable growth in today's dynamic business landscape.

Amanda joined Insperity in fall 2017 as a business performance advisor and has a stellar track record of being an annual top performer, achieving Pinnacle Summit three times and Chairman’s Club twice.

While not at the office, Amanda is mother to two adorable little girls, a wife to an oil & gas entrepreneur and dedicated philanthropist. She enjoys traveling with her family, is an enthusiastic about her board position at Arrow Child & Family Ministries. Amanda always has the best interest of her peers and clients at heart!

Development Director

Sales Xceleration

Michael Nolan is the Development Director – Private Equity and Quality of Sales at Sales Xceleration. He is responsible for building relationships with private equity sponsors and helping their portfolio companies grow their topline performance to build value creation and accelerate performance. Michael and his team leverage a collective of 110 sales leaders with portfolio company experience to help their companies grow 32% in year 1, resulting in $1.7B in revenue growth. Their focus is to drive significant growth through strategy formulation, process development, and effective execution in pre-acquisition due diligence, value acceleration during the hold period, and value maximization to support successful exits.

Partner

Hamilton Robinson Capital Partners

Brandon Richter joined HRCP in 2010 and has led transactions, overseen portfolio company investments and is a member of the Investment and Management Committees. Brandon currently serves as a director of Custom Engineered Wheels, GrayMatter, Sani-Matic and Zone 4. Previously he served as director of W-Technology, Unifiller, Tanknology, Sound Seal and Inspire Automation. Prior to joining HRCP, he worked in the Mergers and Acquisitions group at Bank of America Merrill Lynch on deals across a variety of industry verticals. He began his career at Goldman Sachs in the technology division. Brandon received a B.S. in Electrical and Computer Engineering from Cornell University and his MBA from the Johnson School at Cornell University.

Principal

Brightstar Capital Partners

Noah Siegel is a Principal at Brightstar Capital Partners where he serves on the Board of Directors for Douglas Products, Best Choice Roofing, and Novae.

Prior to joining Brightstar, Noah worked at AEA Investors, focusing on investment opportunities across a range of industries including industrial services and business services. He began his career as a management consultant at McKinsey & Company in the Strategy & Corporate Finance practice.

Noah received his BA in Economics from Yale University, cum laude, and his MBA from the Wharton School of the University of Pennsylvania, where he was a Palmer Scholar.