After the Deal: Managing the Buyer-Seller Relationship Post-Close

Presented By: Baker Hostetler / Sales Xceleration

The deal may be signed but the relationship is just beginning. What happens after the close--from integration planning and culture fit to roll-over equity, RWI, earn-outs, and management incentives. Learn what buyers look for in sellers who stick around, how to avoid post-close pitfalls, and how to structure incentives that keep teams aligned and on track for pulling growth levers immediately.

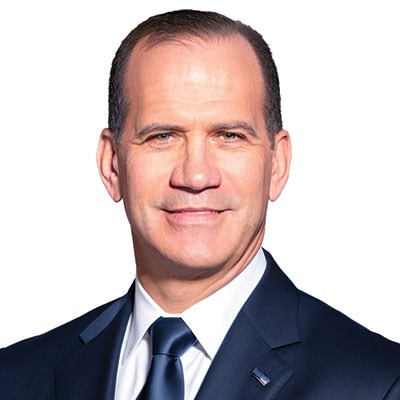

Moderator:

Development Director

Sales Xceleration

Michael Nolan is the Development Director – Private Equity and Quality of Sales at Sales Xceleration. He is responsible for building relationships with private equity sponsors and helping their portfolio companies grow their topline performance to build value creation and accelerate performance. Michael and his team leverage a collective of 110 sales leaders with portfolio company experience to help their companies grow 32% in year 1, resulting in $1.7B in revenue growth. Their focus is to drive significant growth through strategy formulation, process development, and effective execution in pre-acquisition due diligence, value acceleration during the hold period, and value maximization to support successful exits.

Panelists:

Managing Director

SCF Partners

Hossam is a Managing Director and Technology Partner at SCF, overseeing the firm's venture portfolio. With extensive experience in the energy sector, technology development, and commercialization, he evaluates and executes new investment opportunities. Hossam previously founded O&G Technologies, a Houston-based technology incubator, and held leadership positions at Lime Rock Partners and Tercel Oilfield Products. He brings expertise from a 17-year tenure at Schlumberger.

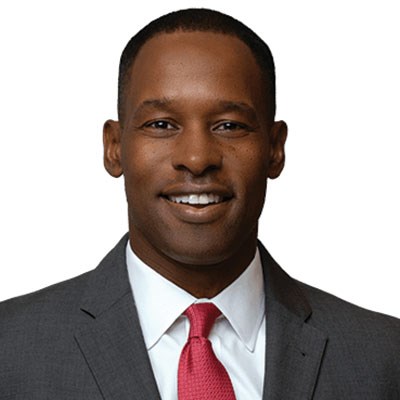

Partner

Baker Hostetler

Cleve Glenn brings a holistic business perspective to his corporate and commercial practice, where he focuses on mergers and acquisitions, corporate governance and outside general counsel services, including drafting and negotiating commercial leases, sale-leaseback transactions, master service agreements, supply agreements and financing documents. His corporate clients include middle market energy companies, real estate development companies, private equity portfolio companies, family offices and financial services companies. Cleve also provides mergers and acquisitions and commercial law counsel to a publicly held rail transportation company providing services to the industrial, energy, transportation and construction industries.

Cleve's background as general counsel and CFO of an energy services company allows him to understand every client's business goals and view each transaction within that framework, resulting in creative solutions with impactful results. A Certified Public Accountant in the state of Texas, he has been named a Top Lawyer in Corporate Finance Mergers and Acquisitions by Houstonia Magazine and a Most Effective Dealmaker by Texas Lawyer.

Founder and Co-Chairman of the Board

United Uptime Services (formerly D&H United Fueling Solutions, Inc.)

An experienced executive that believes in inspirational leadership and people-oriented culture to drive significant growth, outstanding customer service and enterprise value creation. He has had success in driving both organic and M&A growth while achieving multiple successful private equity partnerships and liquidity events. Sasnett founded D&H United Fueling Solutions (now known as United Uptime Services), a leader in sales, service, installation and compliance of fueling and EV charging systems. The company has been named to the prestigious Inc. 5000 list for 4 straight years and has grown to 1,300+ team members and 35 offices across the country.