ESG — environmental, social and governance. This aspect of reporting that public companies undertake has been around for a while. It’s a way for them to respond to investor demands and build public trust. Recently, ESG matters have started to work their way from the public sphere and into private diligence.

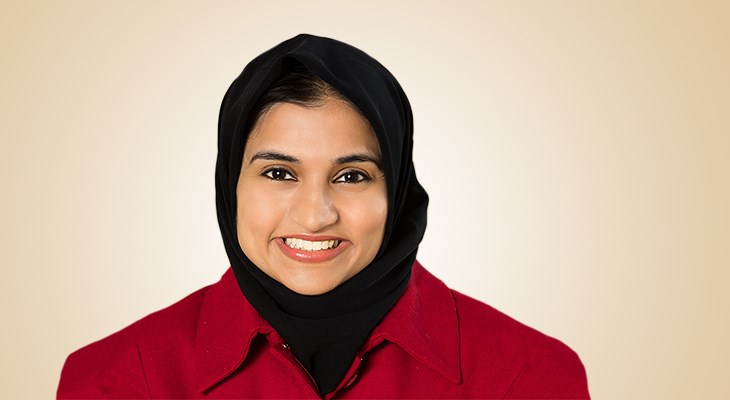

Sehrish Siddiqui, Corporate and Securities Partner at Bass, Berry & Sims, says she’s seeing ESG come up in private deals, especially when private equity is involved. And while there may be some resistance that exists to ESG reporting in private deals, Siddiqui says the reality is that the investment community has begun to demand it.

“Oftentimes, investors are not giving a choice,” Siddiqui says. “If you're wanting to raise capital, you're going to have to incorporate ESG at least to a limited extent”

She says limited partners are demanding a more formal way that ESG factors be considered and that is above and beyond the typical or the traditional due diligence process. With respect to diligence in particular, it could impact the sponsor’s desire to do a deal.

However, especially in the lower middle market or a rapidly growing company, the targets don't often have a fully built-out legal compliance infrastructure, much less this above-and-beyond ESG component. And so it's oftentimes an exercise of identifying items to monitor and follow up as part of an extended post-closing process.

While it may be easy to frame ESG in terms of the consequences of not taking it seriously, Siddiqui says there are other ways to see it.

“It's more of the benefits of doing something,” she says. “Simply put, there tends to be more capital available if you focus on ESG. And beyond access to capital, at the outset as an ongoing matter, I think there's also value creation that's definitely a benefit for a company that focuses on ESG.”

Siddiqui spoke on the Smart Business Dealmakers Podcast about ESG and how it’s affecting private deals. Hit play below to check out the interview.

Listen to the podcast