Subscribe to Smart Business Dealmakers

January 10, 2025

Playing Matchmaker And Managing Deal Stages

By Adam Burroughs

Thomas Kruse of Marsden Holding LLC on the importance of fit when pursuing an inorganic growth strategy.

November 14, 2024

Understanding The LOI As A Seller

Portfolio Creative founder Catherine Lang-Cline on what she learned about LOIs when she sold her business.

October 17, 2024

Doubling Down on Columbus

Dr. Linda Lehmkuhl of MedVet, Aaron Weir of CollisionRight, Kim Zavislak of KPMG, Katie Bishop of J.P. Morgan Private Bank and moderator Leslie Johnson of Ice Miller discuss the opportunities they see in Central Ohio and how they are attacking the challenges of expanding in a city on the rise.

September 19, 2024

Announcing Columbus' Smart Business Dealmaker Award Winners and 2024 Dealmakers Hall of Fame Class

The Smart Business Dealmakers Dealmaker of the Year Awards recognize exceptional individuals who are shaping the landscape of business and innovation in Central Ohio. See who we recognized this year.

August 22, 2024

Market Factors Complicate This Buyer’s Approach To Deals

Kassel Holdings' Tom Werner on the challenges facing buyers in today’s M&A environment.

July 25, 2024

Columbus Deal Activity: The Unpredictable Yet Significant Variable Of Deal Fatigue

MelCap Partners' Mike Kostandaras talks about the phenomenon, highlights deal numbers for the market and spotlights notable Columbus deals.

June 27, 2024

This Seller’s Checklist Starts With Culture Fit

Sophisticated Systems’ Dwight Smith on what he looked for as he prepared to sell his business.

May 22, 2024

Columbus Deal Activity: Navigating M&A turbulence amid economic and political uncertainty

MelCap Partners' Andrew J. Chalhoub talks about M&A trends, and highlights notable local deals, in this month's Columbus Deal Activity.

April 25, 2024

How To Unlock Value and Create Excitement For Investors

CollisionRight's Richard Harrison on the importance of generating investor excitement when executing a roll-up strategy.

March 27, 2024

Columbus Deal Activity: Resurfacing of financial sponsors as both buyers, sellers

Because of the record levels of uninvested capital from record levels of fundraising by private equity groups over the past three years, financial sponsors are expected to be more aggressive and active on the buy side in 2024.

January 18, 2024

Sally Hughes On Letting Go

Sally Hughes founded Caster Connection in 1987 when she started selling chair casters out of the trunk of her car. Over 36 years, she built the business up to include some 3,000 different products,

December 7, 2023

Setting Up The Next Generations

Lisa Ingram, president and CEO of White Castle, on how the 10,000-employee company prepares its family to participate in the business.

November 10, 2023

Deal Activity: The 4th Quarter Comeback

A brief look at history would indicate that total U.S. deal volume and Tom Brady have something in common: completing a 4th quarter comeback.

October 13, 2023

In This Market, Creative Dealmakers Thrive

Slow M&A deal flow in 2022 has trickled into 2023 as more people are standing on the sidelines concerned about rising interest rates and the perpetual threat of a recession. Though deal flow as picked

September 22, 2023

Increasing investment in Central Ohio

On the heels of the Intel announcement that created much buzz in Central Ohio, Chris Michael a partner at Ice Miller LLP, led the kickoff panel at the Columbus Smart Business Dealmakers Conference

August 18, 2023

Columbus Deal Activity: Navigating M&A deal structures in a tightened debt market

As interest rates and borrowing costs move in parallel, buyers are faced with the challenge of navigating increasing costs of debt to finance acquisitions, especially in deals where the seller has

July 14, 2023

Robert H. Schottenstein On How He Diligences Land, Company Acquisitions

M/I Homes, Inc. started in Columbus in 1976, and today is one of the largest home builders in the U.S. Chairman and CEO Robert H. Schottenstein's dad was one of the co-founders of a business that

June 23, 2023

Cindy Monroe On Using Networking To Find The Right Partner For Thirty-One

Thirty-One Gifts founder Cindy Monroe took on a growth equity partner in Kanbrick, the investment firm led by former Warren Buffett deputy Tracy Britt Cool and Brian Humphrey, in July 2020. While she

May 19, 2023

Renewed Focus On Estate Tax As Law Reverts

The landscape of estate tax planning is set to undergo a significant change in the coming years, as the estate tax exemption is set to revert to pre-2018 levels at the end of 2025. This means that

April 26, 2023

Deal Pulse: It's the best of times and the worst of times

The domestic M&A market is in a state of great disparity. Valuations from buyers receded to pre-pandemic levels while sellers continue to expect the lofty valuations seen in the latter portion of 2020

April 14, 2023

A challenging decision to pivot pays off for Jifiti

Jifiti Co-founder and CEO Yaacov Martin on the pivot from the company’s original business concept and how it has grown since.

March 31, 2023

How To Smooth Out The Deal Backend From The Frontend

Priiva Consulting Corporation's Bill Forquer and Stewart Title Group's Sean Stoner on best practices designed to create a smoother process and more successful deals.

March 17, 2023

Andrew Bennett on Provide's Sale To Fifth Third Bank

Provide Chief Business Officer Andrew Bennett spoke on the Smart Business Dealmakers Podcast about Provide's sale to Fifth Third.

March 3, 2023

Columbus Deal Pulse: Positive Trends During Turbulent Times

The Central Ohio M&A market realized a modest decline in deal volume of 20 percent during January 2023 compared to January 2022. Still, several noteworthy transactions occurred in Central Ohio during the month.

February 17, 2023

Are You Emotionally Prepared To Sell?

Windsor Advisory Group Partner Jon Eesley on the personal toll an M&A sales process can take, how to emotionally prepare for an event, and where to get objective advice.

February 3, 2023

ChromoCare's Hugh Cathey On Lessons That Shaped His Career

In a more personal interview, Hugh Cathey, CEO of ChromoCare, a genetics testing firm, spoke on Smart Business SmartTalk about his successes and missteps, who and what helped shape his career, what motivates him and more.

January 20, 2023

STAQ Pharma Expands Operations to Columbus

STAQ Pharma recently raised an estimated $45 Million of Series C venture funding to build a $70 million facility on the West side of Columbus, which will add 300 jobs to the area. Its 503B Outsourcing Facility will produce compounded medications under the Current Good Manufacturing Process (cGMP) quality system, a Federal Drug Administration (FDA) standard. CEO Joe Bagan sat down with Smart Business Network to discuss the capital raises and the new, much larger facility being built in Columbus.

January 6, 2023

So You Want To Invest In Cannabis ...

Scot Crowe, a governing board member at Dickinson Wright and head of the law firm's private equity practice, on the latest trends in the red-hot cannabis industry.

December 9, 2022

Plenty Of Prep Helps Updox Accelerate Sale Timeline

Former Updox CEO Mike Morgan on building up Updox, the process of selling to EverCommerce, and why he chose to leave the company after the sale.

November 11, 2022

Young People See Startups As A Way To Make An Impact

Ohio Innovation Fund Principal Faith Voinovich on changes she's seen in early-stage investing and shares her view of the broader startup picture.

October 28, 2022

Deal Pulse Columbus: M&A Outlook in a Volatile Economy

Columbus M&A for the nine months ended September 30, 2022 was 29.1 precent lower than the same time period in 2021, while September 2022 deal volume was 57.1 percent lower than September 2021.

October 14, 2022

How Jordan Hansell Is Applying Past Experiences To Lead Tradepost

Tradepost's Jordan Hansell on launching and growing TradePost, how his experience is shaping his approach in the new venture, as well as a series of recent investments he's made in the real estate space, a sector he says is poised for disruption.

September 30, 2022

Evaluating The Columbus Deal Market

Stonehenge Partners' Sean Dunn, Ice Miller's Chris Michael, Kaufman Development's Ian Labitue, Worthington Industries' Patrick Kennedy and MEMM Capital'sMark Fleming Jr. kick off the Columbus Smart Business Dealmakers Conference with an evaluation of the current Columbus deal market.

September 15, 2022

Deal Pulse: The economic impact of manufacturing resurgence

In his latest Deal Pulse report, Mike Kostandaras of MelCap Partners assesses the current M&A market, including a discussion of recent deals, a puts a spotlight on domestic manufacturing.

September 2, 2022

Ilya Bodner on Bold Penguin's Acquisition

Bold Penguin Founder Ilya Bodner on the company's acquisition, how it decided that was the best choice and the benefits the deal offered.

August 19, 2022

Deal Pulse: COVID's continued M&A impact

The Central Ohio M&A market has exhibited a similar trend as the broader domestic market, as deal volume for the seven months ended July 2022 was 18.6 percent lower than the prior year. Meanwhile, Central Ohio deal volume fell by 24 percent in July 2022 relative to July 2021.

August 5, 2022

How to be transparent while protecting IP during diligence

Stirling Ultracold Founder and former CTO Dave Berchowitz on the deal with BioLife and how the company's IP was managed leading up to and through diligence.

July 22, 2022

An offer that can't be refused

Dawson's' David DeCapua on the deal with Aya Healthcare and how he personally came to terms with selling.

July 6, 2022

Landing the first investors

SureImpact's Sheri Chaney Jones on launching SureImpact and her experience landing investors.

June 22, 2022

The importance of multiple plans

Capital Plus' Renee Tyack, Roetzel & Andress' Erika Haupt, Matesich Distributing Co.'s Sarah Schwab and AB Bernstein's Kara Lewis on how they navigated the most difficult questions regarding what to do with the family business.

June 10, 2022

How WeCare Medical Got Sophisticated Ahead of Its AdaptHealth Deal

WeCare Medical Joda Burgess, along with Footprint Capital's Josh Curtis, GBQ Partners' Wade Kozich, MAD Capital's Jim Baich and Oxer Capital's Michael OBrien discuss WeCare Medical's sale to AdaptHealth, and how sellers can maximize their understanding of the deal phases to achieve a successful transaction.

May 11, 2022

Get your priorities straight before a sale

Aegis Advisors' Fred Vorys, along with Oxer Capital Inc.'s Dan Phlegar, BMO's Lowell Jacobson and Tiller Corporation's Steven Sauer, on the decision making that precedes a liquidity event.

April 1, 2022

Capital is not a differentiator

Physna's Paul Powers, Blacksmith Applications' Terry Ziegler and Fifth Third's Jeremy Gutierrez and Joshua Sosland talk about building strong capital stacks to finance growth.

March 4, 2022

Reducing deal friction

Zell Capital and Nikola Labs' Will Zell, along with Benesch's Michael Farrell and Andy Bojko, and Aon's Doug Brody, broke down best practices in navigating what’s new, and how to overcome stumbles, stops and re-starts in a process.

February 4, 2022

When selling, get advisers who know your niche

Hy-Tek's Sam Grooms, along with Thompson Hine's Sarah Chambers, Smile Doctors' Dale AnneFeatheringham and Sequoia Financial Group's Norm Cook peel back the curtain and share the secrets of their successes, as well as the pitfalls you should try to avoid when approaching the sale of your business.

January 7, 2022

Stay ready: the benefit of a perpetual data room

Cloudbreak's Andy Panos, along with U.S. Bank's Steve Bennett, Nottingham Spirk's Katherine Hill Ritchie and Armada Waste Ohio's Robert Smith on staying prepared for a transaction.

November 12, 2021

Drafting Your Acquisition Playbook

HBD Industries Tom Pozda, along with The Huntington National Bank’s Mark Slayman, Salon Lofts’ Chris Greenfelder, Copper Run’s Andrew Hays and Huntington’s Chad Lowe, offer tips an insights on how to prepare for buy-side transactions.

September 30, 2021

Capital velocity trend predicated on speed, volume

Talisman Capital Partners' Matt Bennett and Root's Kumi Walker, along with Tri-W Group's Paige McCarthy and Ice Miller LLP's Chris Michael explore new and emerging perspectives in M&A.

August 6, 2021

Not all CEOs are enthralled by the red-hot M&A market

Vistage Columbus Chair Perry Maughmer spoke on the Smart Business Dealmakers Podcast about the CEO mindset in a time of incredible M&A activity.

June 11, 2021

Josh Curtis on what M&A’s busiest year means for sellers

Josh Curtis, managing director of Footprint Capital, offers his view of the market from both the sell-side and buy-side, as well as his sense of how things could play out for the balance of the year.

May 13, 2021

Cindi Englefield offers sale perspective from both sides of the table

Cindi Englefield shares what she sees from the outside when helping business owners sell their business, as well as insight and advice gained from her sale experience.

March 31, 2021

Tami Longaberger on being on the other side of the investing table

Tami Longaberger talks about her time as an operator informs her approach as an investor, what she’s seeing in the secure data ecosystem space, and the future of the Longaberger Co. brand.

March 5, 2021

For Bill Lee, approachability is key when investing

Bill Lee, serial entrepreneur and investor, on what he’s learned over his years of buying, selling and investing.

February 5, 2021

Pam Springer warns against “generals” when investing

Serial entrepreneur and investor Pam Springer on how to be an effective investor.

January 8, 2021

Dealmaker Conversations: Hugh Cathey

ChromoCare CEO Hugh Cathey shares his insights on the M&A market and his outlook for future dealmaking.

December 11, 2020

Carlton D. Dean III on how the pandemic reshaped deal priorities

Carlton D. Dean III talks about how the pandemic has affected both the state of the market, and the state of his M&A thinking.

October 2, 2020

Kassel Equity Group's Brett Motherwell on balancing dealmaking opportunity and risk

Kassel Equity Group Managing Partner Brett Motherwell talks dealmaking during the pandemic and the importance of careful deal structures to mitigate M&A risks.

July 9, 2020

AB Bernstein’s Kara Lewis and Heather George on the seller fatigue factor

AB Bernstein's Kara Lewis and Heather George explores the seller mindset and how that might affect deal availability for buyers.

June 12, 2020

Chromocare’s Hugh Cathey: It’s time for careful, creative thinking

It's a challenging business environment right now, which calls for care and out-of-the-box thinking. Hugh Cathey discusses what he’s seeing in today’s market through the lens of both business owner and investor.

May 15, 2020

Ice Miller’s Michael Jordan and Rob Ouellette: M&A and business in a turbulent market

Are deals dead? Ice Miller Partner Rob Ouellette says “no,” but they have taken on a different look. Ouellette and Ice Miller Managing Partner Michael Jordan share their thoughts on M&A and other issues C-suite executives are dealing with during the COVID-19 crisis.

May 13, 2020

Deal Pulse: April M&A Activity in Central Ohio

The state of Ohio was under a stay-at-home order for the entire month of April, with many businesses shut down. While middle market M&A activity has severely slowed in Central Ohio, notable deals included Break Trail Ventures, Nationwide Ventures and Midwest Equipment Sales.

April 17, 2020

Deal Pulse: March M&A Activity in Central Ohio

M&A activity in Central Ohio continues to move forward despite the impact of the coronavirus on the markets and Ohio’s mandated shutdown of non-essential businesses and “shelter-in-place” orders given in March.

April 1, 2020

Drive Capital’s Chris Olsen on how coronavirus impacts VC

Drive Capital partner Chris Olsen talks about the state of dealmaking, what portfolio companies should expect from their shareholders and his advice for investors.

March 23, 2020

Deal Pulse: Central Ohio companies active in health care tech

Central Ohio companies were active last month in transactions involving health care tech. Copper Run Capital's Michael Shaw shares what deal activity he's seen throughout February 2020.

February 27, 2020

Michael Redd: Applying lessons from the NBA to the venture world

Michael Redd is often more concerned about the leaders than the product; if the product isn’t right, the company can pivot. The angel investor and venture partner shares what he's learned about investing and how his experience as a professional athlete in the NBA frames it.

February 26, 2020

Deal Pulse: Investors Back Columbus Tech Firms

Recently, investors made significant investments into Columbus-based tech companies that are forward thinking and utilizing new technologies in the marketplace. Copper Run Capital's Michael Shaw shares what deal activity he's seen throughout January 2020.

February 14, 2020

Investing in Ohio’s medical marijuana industry

The cannabis space is an interesting investment opportunity that comes with a variety of risks, but as Ohio’s medical marijuana cultivators and dispensaries slowly gain ground, the nascent industry should pick up speed in 2020.

January 27, 2020

Marc Hawk: Take on investors with care, great care

With no collateral and a high-powered growth strategy, RevLocal had to utilize angel and equity investing to grow. CEO Marc Hawk shares how the digital marketing company selected the right investors.

January 22, 2020

Dave Enright breaks down the capital stack

Dave Enright has a lot of experience in the "wild, wild west" of buying — deals that are below $5 million EBIDTA. The senior vice president and commercial banker at S&T Bank digs into the financing behind buying companies in the lower middle market.

January 17, 2020

Victor Thorne takes a smarter, more disciplined approach to investing

Victor Thorne was bit by the entrepreneur bug early. In his mid 20s, he started his first company with his older brother. Today, the partner at Origin Malt is still enthusiastic about investing and entrepreneurship, but his focus has changed.

January 2, 2020

Dealmaking predictions for 2020’s M&A activity in Central Ohio

Smart Business Dealmakers spoke with Ice Miller's Rob Ouellette, Dickinson Wright's Scot Crow and U.S. Bank's Steve Bennett about what they forecast for the 2020 dealmaking climate.

December 24, 2019

Columbus 2019 Dealmaking Year in Review

With 2019 just about over, we’re taking a look back at some of what we learned this year.

December 18, 2019

Hawthorne’s Katy Wiles: With the right process, buyers can minimize deal disruption

Katy Wiles has learned a thing or two about running an efficient deal process on the buy side. The lead attorney and legal adviser for Hawthorne Gardening Co., a wholly owned subsidiary of Scotts Miracle-Gro., shares her take on creating a core team and how deal processes should work.

December 4, 2019

Stonehenge’s Andrew Bohutinsky: The value of operators with skin in the game

When Stonehenge Partners invests in a business, it’s looking for operators who have skin in the game. This means, as a fund, it often finds the most opportunity through minority recapitalizations, says Managing Partner Andrew Bohutinsky.

November 19, 2019

Stadion Capital’s Michael Scott: You cannot outstructure a bad deal

When Michael Scott went out on his own in 2010, after more than 20 years of private equity and M&A experience, he knew there was no room for mistakes. That's why he looked for opportunities with a competitive advantage.

November 7, 2019

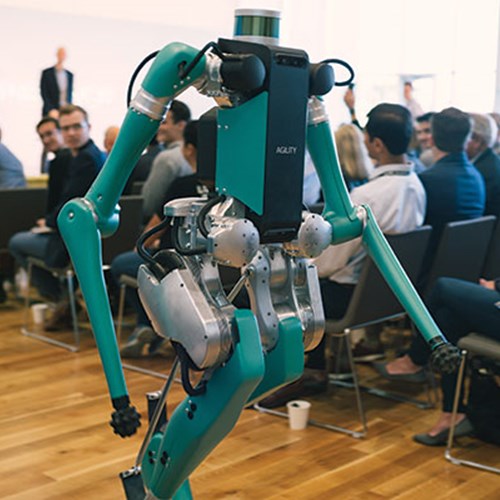

Robots, automation and AI, oh my!

Last month, participants in Columbus VC firm Drive Capital’s second robotics and automation summit — Devol’s Dance — spent the day exploring the future. While automation is critical to many of Drive Capital’s portfolio companies, two researchers shared how robots, overall, are changing the way we think and how we do our jobs.

November 1, 2019

It took some hard lessons for Bob Grote to learn the best way to acquire companies

Bob Grote has been CEO of Grote Co. for more than a decade, but even after five acquisitions, he has to guard against deal fever. Grote discusses deal challenges and lessons learned.

October 22, 2019

The preparation with Myonexus pays off for Michael Triplett

Selling can be emotionally exhausting, but Michael Triplett knows extensive preparation was critical for the successful sale of Myonexus Therapeutics to Sarepta Therapeutics earlier this year. He looks back on the $165 million deal.

October 18, 2019

Always on the lookout for opportunities, Rhett Ricart sees talent as key

Rhett Ricart, who has bought and sold a number of dealerships over the years for Ricart Automotive, shares his M&A strategies and how the family business is tackling succession planning.

October 3, 2019

Safelite's Tom Feeney: Speed, Focus Are Keys To Integration

After 100 deals during his time at Safelite, the CEO says he may have slowed the number of acquisitions, but he won't slow the pace of integrating the companies he does buy.

September 27, 2019

2019 Columbus Dealmaker Of The Year Awards

The Smart Business Dealmakers Conference brought together hundreds of entrepreneurs, investors and advisers at the Hilton Columbus Downtown on Sept. 25. During the conference, Smart Business

September 24, 2019

Deal Veteran Mike Sayre Pulls Back Curtain With Lessons Learned

Innovative Leadership Institute President Mike Sayre shares lessons learned from decades of dealmaking.

September 20, 2019

Hugh Cathey: Smart Fundraising Requires Monitoring Market

Serial entrepreneur Hugh Cathey, now on his ninth startup with genetic testing company ChromoCare, shares his best practices for raising capital.

September 6, 2019

Mark Kovacevich: Culture Is King In Acquisitions

For Improving's Mark Kovacevich, the critical component to acquisitions has always been culture. “If the culture doesn’t work, the transaction is just not [going to work],” he says.

September 6, 2019

Before Buying, Consider Challenges As Well As Opportunities

Chris Gabrelcik always sees potential opportunities when looking to buy a company. But the CEO of Lubrication Specialties has to remind himself to bring a critical eye to the deal.

August 29, 2019

Innkeeper Ellen Grinsfelder Finds The Right Buyer Second Time Around

The first time Ellen Grinsfelder tried to sell the Inn & Spa at Cedar Falls was a bust. Three years later, she sold it without ever having to list it. Here's how she did it.

August 28, 2019

Ilya Bodner blazes insuretech trail with Bold Penguin

Serial entrepreneur Ilya Bodner says every startup needs an idea, capital and great people. That's become the lens through which he makes all his decisions in building Bold Penguin, his fast-growing insuretech business.

August 21, 2019

How Advanced Drainage Systems Fast-Tracked Infiltrator Acquisition

CEO Scott Barbour grabbed the pole position, and never let his foot off the gas in his bid to close the $1 billion deal.

August 8, 2019

Structuring Your Own Deal: 'They Thought We Were Nuts'

When the co-owners of Two Men and A Truck – Columbus came up with a unique plan to sell their franchise to an employee, their lawyers were skeptical. Very skeptical. But after two false starts, Gail and John Kelley sold the moving company's No. 2 franchise.

August 6, 2019

Collaboration, corporates draw Heartland Ventures to Columbus

South Bend, Ind.-based Heartland Ventures, which focuses on connecting startups to corporations, picked Columbus out of 15 Midwest cities for expansion because of the corporate involvement in the city's collaborative early-stage community.

July 25, 2019

Kassel Equity Shifts Buying From Properties To Businesses

After cutting his teeth on real estate investing, Kassel Equity found it could create more value in buying businesses than properties, says Managing Partner Brett Motherwell.

July 17, 2019

Ice Miller’s Michael Jordan: Investor Appetite For Alternatives Remains High

Michael Jordan didn’t expect to become an expert in investor-side representation for alternative investments. He stumbled into the niche 22 years ago. Here's what he's seeing in the marketplace.

July 2, 2019

Finance Fund plays vital investment role in local communities

Finance Fund connects underserved communities in Ohio with public and private sources of capital to improve access to healthy food, health care service, education and affordable housing.

June 26, 2019

Aggressive buyers fast-track due diligence in seller’s market

It’s a seller’s market, and large strategic buyers are being very aggressive — in some cases, short-cutting due diligence processes, says Wade Kozich, senior advisor with boutique investment bank Footprint Capital and senior director at GBQ Partners.

June 19, 2019

For Allison Finkelstein, cap tables play critical role in investing

Startup founders should focus on how to achieve reasonable growth to get the next round of funding, the experience angel investor says.

June 12, 2019

Family offices grow in number and sophistication

Private banker Reese Fields discusses how family offices operate, including balancing privacy with connecting to potential investments.

June 5, 2019

Quantum Health’s Kara Trott on raising capital without losing control

How the CEO of the health care company brought on three rounds of investors, while keeping control of the business she founded.

May 22, 2019

Stonehenge's Peter Davies: How to buy in a peak market

The managing partner of Stonehenge Partners shares his approach to buying with multiples approaching a peak, and how buying strategies have changed in the current environment.

May 15, 2019

Ohio State builds momentum for innovation district development

For years, the future of The Ohio State University west campus has been up in the air. That’s changing with the first three buildings planned for an eventual innovation district.