Subscribe to Smart Business Dealmakers

By Mike Kostandaras

MelCap Partners' Mike Kostandaras talks about the phenomenon, highlights deal numbers for the market and spotlights notable Columbus deals.

May 22, 2024

Columbus Deal Activity: Navigating M&A turbulence amid economic and political uncertainty

MelCap Partners' Andrew J. Chalhoub talks about M&A trends, and highlights notable local deals, in this month's Columbus Deal Activity.

March 27, 2024

Columbus Deal Activity: Resurfacing of financial sponsors as both buyers, sellers

Because of the record levels of uninvested capital from record levels of fundraising by private equity groups over the past three years, financial sponsors are expected to be more aggressive and active on the buy side in 2024.

November 10, 2023

Deal Activity: The 4th Quarter Comeback

A brief look at history would indicate that total U.S. deal volume and Tom Brady have something in common: completing a 4th quarter comeback.

April 26, 2023

Deal Pulse: It's the best of times and the worst of times

The domestic M&A market is in a state of great disparity. Valuations from buyers receded to pre-pandemic levels while sellers continue to expect the lofty valuations seen in the latter portion of 2020

March 3, 2023

Columbus Deal Pulse: Positive Trends During Turbulent Times

The Central Ohio M&A market realized a modest decline in deal volume of 20 percent during January 2023 compared to January 2022. Still, several noteworthy transactions occurred in Central Ohio during the month.

January 6, 2023

So You Want To Invest In Cannabis ...

Scot Crowe, a governing board member at Dickinson Wright and head of the law firm's private equity practice, on the latest trends in the red-hot cannabis industry.

November 11, 2022

Young People See Startups As A Way To Make An Impact

Ohio Innovation Fund Principal Faith Voinovich on changes she's seen in early-stage investing and shares her view of the broader startup picture.

October 28, 2022

Deal Pulse Columbus: M&A Outlook in a Volatile Economy

Columbus M&A for the nine months ended September 30, 2022 was 29.1 precent lower than the same time period in 2021, while September 2022 deal volume was 57.1 percent lower than September 2021.

September 30, 2022

Evaluating The Columbus Deal Market

Stonehenge Partners' Sean Dunn, Ice Miller's Chris Michael, Kaufman Development's Ian Labitue, Worthington Industries' Patrick Kennedy and MEMM Capital'sMark Fleming Jr. kick off the Columbus Smart Business Dealmakers Conference with an evaluation of the current Columbus deal market.

September 15, 2022

Deal Pulse: The economic impact of manufacturing resurgence

In his latest Deal Pulse report, Mike Kostandaras of MelCap Partners assesses the current M&A market, including a discussion of recent deals, a puts a spotlight on domestic manufacturing.

August 19, 2022

Deal Pulse: COVID's continued M&A impact

The Central Ohio M&A market has exhibited a similar trend as the broader domestic market, as deal volume for the seven months ended July 2022 was 18.6 percent lower than the prior year. Meanwhile, Central Ohio deal volume fell by 24 percent in July 2022 relative to July 2021.

September 30, 2021

Capital velocity trend predicated on speed, volume

Talisman Capital Partners' Matt Bennett and Root's Kumi Walker, along with Tri-W Group's Paige McCarthy and Ice Miller LLP's Chris Michael explore new and emerging perspectives in M&A.

August 6, 2021

Not all CEOs are enthralled by the red-hot M&A market

Vistage Columbus Chair Perry Maughmer spoke on the Smart Business Dealmakers Podcast about the CEO mindset in a time of incredible M&A activity.

June 11, 2021

Josh Curtis on what M&A’s busiest year means for sellers

Josh Curtis, managing director of Footprint Capital, offers his view of the market from both the sell-side and buy-side, as well as his sense of how things could play out for the balance of the year.

December 11, 2020

Carlton D. Dean III on how the pandemic reshaped deal priorities

Carlton D. Dean III talks about how the pandemic has affected both the state of the market, and the state of his M&A thinking.

May 15, 2020

Ice Miller’s Michael Jordan and Rob Ouellette: M&A and business in a turbulent market

Are deals dead? Ice Miller Partner Rob Ouellette says “no,” but they have taken on a different look. Ouellette and Ice Miller Managing Partner Michael Jordan share their thoughts on M&A and other issues C-suite executives are dealing with during the COVID-19 crisis.

May 13, 2020

Deal Pulse: April M&A Activity in Central Ohio

The state of Ohio was under a stay-at-home order for the entire month of April, with many businesses shut down. While middle market M&A activity has severely slowed in Central Ohio, notable deals included Break Trail Ventures, Nationwide Ventures and Midwest Equipment Sales.

April 17, 2020

Deal Pulse: March M&A Activity in Central Ohio

M&A activity in Central Ohio continues to move forward despite the impact of the coronavirus on the markets and Ohio’s mandated shutdown of non-essential businesses and “shelter-in-place” orders given in March.

April 1, 2020

Drive Capital’s Chris Olsen on how coronavirus impacts VC

Drive Capital partner Chris Olsen talks about the state of dealmaking, what portfolio companies should expect from their shareholders and his advice for investors.

March 23, 2020

Deal Pulse: Central Ohio companies active in health care tech

Central Ohio companies were active last month in transactions involving health care tech. Copper Run Capital's Michael Shaw shares what deal activity he's seen throughout February 2020.

February 26, 2020

Deal Pulse: Investors Back Columbus Tech Firms

Recently, investors made significant investments into Columbus-based tech companies that are forward thinking and utilizing new technologies in the marketplace. Copper Run Capital's Michael Shaw shares what deal activity he's seen throughout January 2020.

February 14, 2020

Investing in Ohio’s medical marijuana industry

The cannabis space is an interesting investment opportunity that comes with a variety of risks, but as Ohio’s medical marijuana cultivators and dispensaries slowly gain ground, the nascent industry should pick up speed in 2020.

January 2, 2020

Dealmaking predictions for 2020’s M&A activity in Central Ohio

Smart Business Dealmakers spoke with Ice Miller's Rob Ouellette, Dickinson Wright's Scot Crow and U.S. Bank's Steve Bennett about what they forecast for the 2020 dealmaking climate.

November 7, 2019

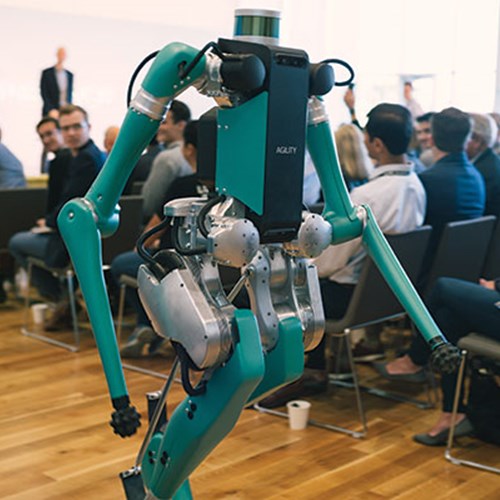

Robots, automation and AI, oh my!

Last month, participants in Columbus VC firm Drive Capital’s second robotics and automation summit — Devol’s Dance — spent the day exploring the future. While automation is critical to many of Drive Capital’s portfolio companies, two researchers shared how robots, overall, are changing the way we think and how we do our jobs.

August 6, 2019

Collaboration, corporates draw Heartland Ventures to Columbus

South Bend, Ind.-based Heartland Ventures, which focuses on connecting startups to corporations, picked Columbus out of 15 Midwest cities for expansion because of the corporate involvement in the city's collaborative early-stage community.

July 17, 2019

Ice Miller’s Michael Jordan: Investor Appetite For Alternatives Remains High

Michael Jordan didn’t expect to become an expert in investor-side representation for alternative investments. He stumbled into the niche 22 years ago. Here's what he's seeing in the marketplace.

July 2, 2019

Finance Fund plays vital investment role in local communities

Finance Fund connects underserved communities in Ohio with public and private sources of capital to improve access to healthy food, health care service, education and affordable housing.

June 12, 2019

Family offices grow in number and sophistication

Private banker Reese Fields discusses how family offices operate, including balancing privacy with connecting to potential investments.

May 15, 2019

Ohio State builds momentum for innovation district development

For years, the future of The Ohio State University west campus has been up in the air. That’s changing with the first three buildings planned for an eventual innovation district.