Root Insurance, the country’s largest property casualty insuretech company, has raised $350 million in Series E funding. The Columbus-headquartered company has now raised a total of $523 million in funding, with an additional $100 million in debt financing. This latest round, led by DST Global and Coatue, raises Root’s valuation to $3.65 billion and provides additional capital to accelerate growth in existing markets while expanding into new states and developing new product lines.

Existing investors Drive Capital, Redpoint Ventures, Ribbit Capital, Scale Venture Partners and Tiger Global Management all participated in this round, along with several new investors.

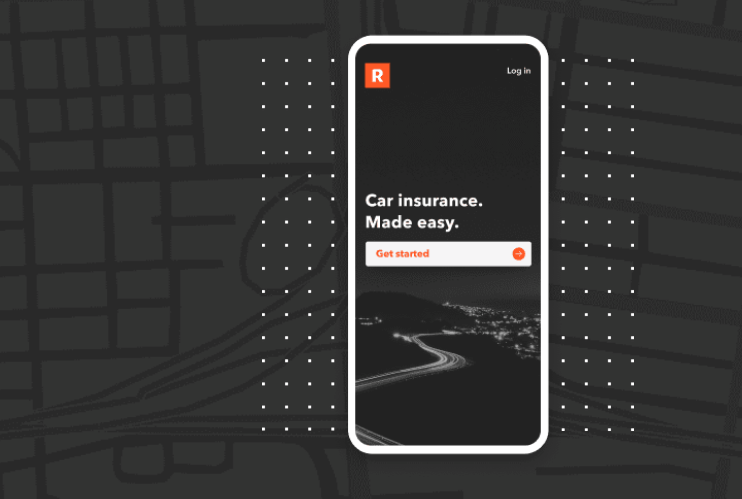

Root recently expanded into its 29th state and is now available to more than 65 percent of the U.S. driving population. The company, founded in 2015, wrote more than $187 million in insurance premiums in the first six months of 2019, 824 percent growth over the same period in 2018. Root uses smartphone technology to understand individual driving behavior, as well as a unique algorithm to price its auto insurance.

“We are thrilled that our success continues to attract leading investors who recognize the impact Root has already had on the industry and the opportunity still ahead,” Root co-founder and CEO Alex Timm said, in a statement. “This latest capital will allow us to extend our innovation lead and accelerate our strategy to transform the car insurance world for the benefit of consumers.”

Coatue is one of the world’s largest dedicated technology funds with offices in New York, Menlo Park, San Francisco and Hong Kong. Coatue manages approximately $17 billion in assets on behalf of individuals, endowments, foundations and other institutional investors.

DST Global is one of the leading investment groups globally to focus exclusively on Internet related companies. DST Global is headquartered in Hong Kong and has offices in Beijing, London, New York and Silicon Valley. Its portfolio includes some of the world’s leading and most valuable internet assets.