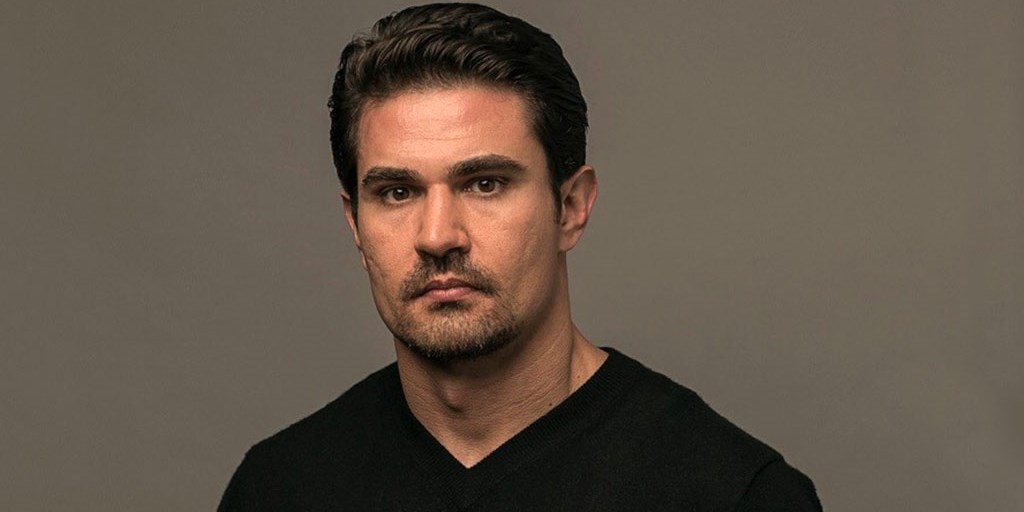

Every dealmaker remembers “the one that got away,” none more so than Cleveland businessman Bobby George.

“There were a few real estate deals I passed on in 2009, and every time I drive by them, I get a feeling in the pit of my stomach,” says George, owner of TownHall, Barley House and Rebol, as well as founder and president of George Capital Partners. “It’s cost me millions of dollars.

“I was so cautious because I was just starting to make money and I didn’t want to overextend myself. I didn’t have the deal principles then that I have now.”

Today, George consults his list of dealmaking principles on a weekly basis – and uses them to inform his investment decisions.

“Every dealmaker has different principles that are important to them,” he explains. “As long as you stick to those principles, you’re usually successful.

“I focus on companies that I can handle — smaller to midsized companies, or cash flow in companies that have some kind of asset backed. I try to avoid startup companies. And I love companies that, when I buy, I can use my knowledge to help generate revenue or turn the needle and add value.”

In this week’s Dealmaker Strategy, George talks about how he evaluates acquisitions to seize opportunity when it strikes.

Check for compatibility

If I can understand the business based on my experience, that’s the first step. If I can’t, I’m not interested. Once I understand it, I want to see how well the company is positioned and I want to understand the leadership. If I believe in the leadership and that the leader is the right person, I take the next step. If I don’t, I don’t have the resources to move forward and I won’t.

Approach your seller with compassion

If you approach [the seller] too aggressively, they might get offended. They might not be interested in a sale and might not see the synergy. As I’ve gotten older, I’ve gotten a lot more compassionate about how I approach someone. I don’t want to offend, and I don’t want to hurt someone’s feelings. They could take it the wrong way — as if you think they’re doing a bad job — when really, you’re interested in buying their business because they’ve done a lot of good things.

Ensure financial accountability

I want to see where the margins are, what potential growth opportunities there are and what the revenue is. Then the last thing I make sure of is that I can make the right deal. Any deal I do, I like to take control of and have majority ownership. If I don’t have majority ownership, I like to have the right controls in place where if they don’t hit financial benchmarks, I have the right to take over operations — immediately.

Don’t repeat mistakes, but do reflect on them

The reason I look back is that I don’t want to continue to make the same mistake. I can look back at properties I didn’t buy that I should’ve bought and analyze why I didn’t buy them.

Don’t let money be the deal breaker

Unless it’s something way out of your range and it’s going to take way too much time to put the money together, or it’s way too risky, if you can put the deal together and you know it’s the right deal, do it. Even if you have to give up more equity. As long as you can stay in control. I’ve learned that, and as I’ve gotten older, I’ve gotten a little more aggressive.

Related video